Planning a Budget with a Stable Income

Whether you have a stable salary or fixed income, understanding budgets is the key to making the best use of them.

After all, a stable income means you know with certainty how much money you have available for bills and routine expenses. However, it may not compensate for an unexpected emergency.

Budgeting isn’t just for those tight on money – it helps anyone meet their short-term savings goals and long-term retirement plans. How can you develop a more stable financial lifestyle? Let’s take a look.

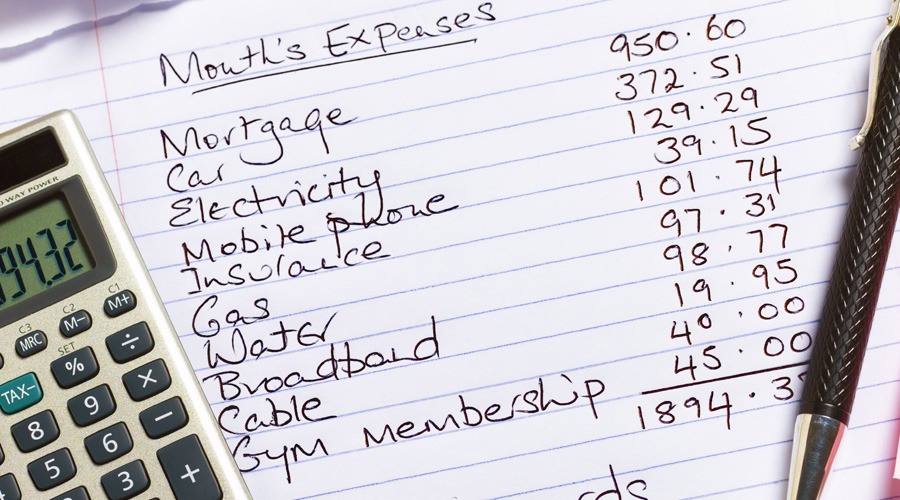

Fixed and Variable Expenses vs. Luxuries

Your income should be more than your fixed expenses, such as rent, insurance premiums, car payments, and so on. It should also compensate for variable expenses, like food and transportation. With those expenses taken care of, your basics are covered.

From there, you can establish a budget for non-necessities. This includes entertainment, dining out, and luxury items. Some of these can be difficult to cut back on, especially once you feel you’ve found a comfortable lifestyle – like keeping all of your streaming services or going out with your partner once or twice a week.

You can still enjoy these luxuries! Just be sure your budget can accommodate them safely, while still leaving room for your other budget-worthy costs.

Make Savings a Fixed Expense

After paying all your bills and setting aside cash for variable expenses, come to a decision on what percentage of your paycheck should go into your savings account.

Most people aim to stash away 10% of each paycheck. However, you may feel more comfortable putting away only 5% in order to maintain your lifestyle, or you may decide to push yourself and save even more in order to meet your savings goals. It helps to save first and then play with your remaining money, rather than the other way around.

Track Your Purchases Closely

Keeping track of your expenses helps you map out where your money goes. Set aside time for this task on a regular basis, such as daily or weekly.

It’s easy for minor expenses to quickly add up, such as going to the movies every week. Next thing you know, you’re down $50 or $100 each month that wasn’t accounted for, which may cut into your savings.

It’s wise to keep your receipts or use your debit or credit card transaction history to document your spending. Spreadsheets and mobile apps are also an easy way to visually map out your budget, rather than working from memory.

Lauren Ward

Lauren Ward